The XRP market is once again in the spotlight as fresh legal uncertainties, rising ETF speculation, and a wallet glitch controversy fuel investor debate.

Despite Ripple CEO Brad Garlinghouse’s earlier confidence in a legal victory, the SEC has yet to formally withdraw its appeal, keeping the Ripple lawsuit alive in the minds of traders. Meanwhile, Ripple CTO David Schwartz stepped in to calm fears after a 10,000 XRP bug triggered community panic. With ETF hopes climbing and market tension building ahead of the SEC’s May 8 meeting, XRP finds itself at a critical crossroads.

Market Stumbles as XRP Faces Renewed Legal and Technical Jitters

XRP’s price fell for a second consecutive day, dipping by 0.97% on Saturday to close at $2.1882, trailing Friday’s 0.14% loss. This comes amid broader market weakness and rising investor anxiety over the Securities and Exchange Commission’s (SEC) hesitation to formally withdraw its appeal in the ongoing Ripple lawsuit. The overall crypto market slid 1.07%, shrinking the total market capitalization to $2.94 trillion.

XRP was trading at around $2.19, down 0.72% in the last 24 hours at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

The delay has put added pressure on Ripple XRP news, with many now focusing on the SEC’s next closed meeting, scheduled for May 8, as a potential turning point in the XRP lawsuit update. Hopes are high that this meeting may finally result in the formal dismissal of the SEC’s challenge to Judge Torres’ ruling that Ripple’s programmatic sales of XRP did not violate securities laws.

SEC Stalemate Fuels Uncertainty in Ripple Lawsuit

Despite previous announcements from Ripple CEO Brad Garlinghouse suggesting the SEC was ready to dismiss its appeal, the formal process remains incomplete. Garlinghouse clarified, “We have reached agreement with staff. […] Staff makes recommendations to the Commission, and then the Commission votes. The Commission hasn’t yet voted. But what we’ve agreed is to dismiss and move on.”

Crypto journalist Eleanor Terrett also commented, noting, “The Commission still has to formally approve the withdrawal. […] They’ll probably address the Ripple dismissal at its next closed-door meeting which is next Thursday.”

This legal limbo has contributed to growing market hesitation, with traders awaiting clearer signs before making major moves. The SEC Ripple case continues to shape sentiment around the Ripple market and the broader crypto regulatory environment in the U.S.

XRP Price Prediction: Legal Progress Could Spark Breakout

XRP remains technically pinned below its 50-day Exponential Moving Average (EMA), though still above its 200-day EMA—indicating near-term bearishness but longer-term support. The 14-day Relative Strength Index (RSI) sits at 51.82, suggesting room for growth before hitting overbought conditions.

XRP remains in accumulation, failing to break key resistance levels—no trend reversal confirmed yet. Source: bgn0192 on TradingView

If XRP manages to clear the $2.22 resistance level, analysts expect it could test the $2.50 mark, with a broader rally potentially pushing it toward $3.00 and even its all-time high of $3.5505. On the downside, a fall below the $2.05 support could drag XRP closer to $1.93.

Meanwhile, odds for a U.S. XRP-spot ETF approval by year-end have jumped to 79%, according to Polymarket data, up from 68% in late April. However, analysts note that the SEC may need to formally end the XRP SEC lawsuit before approving such a product.

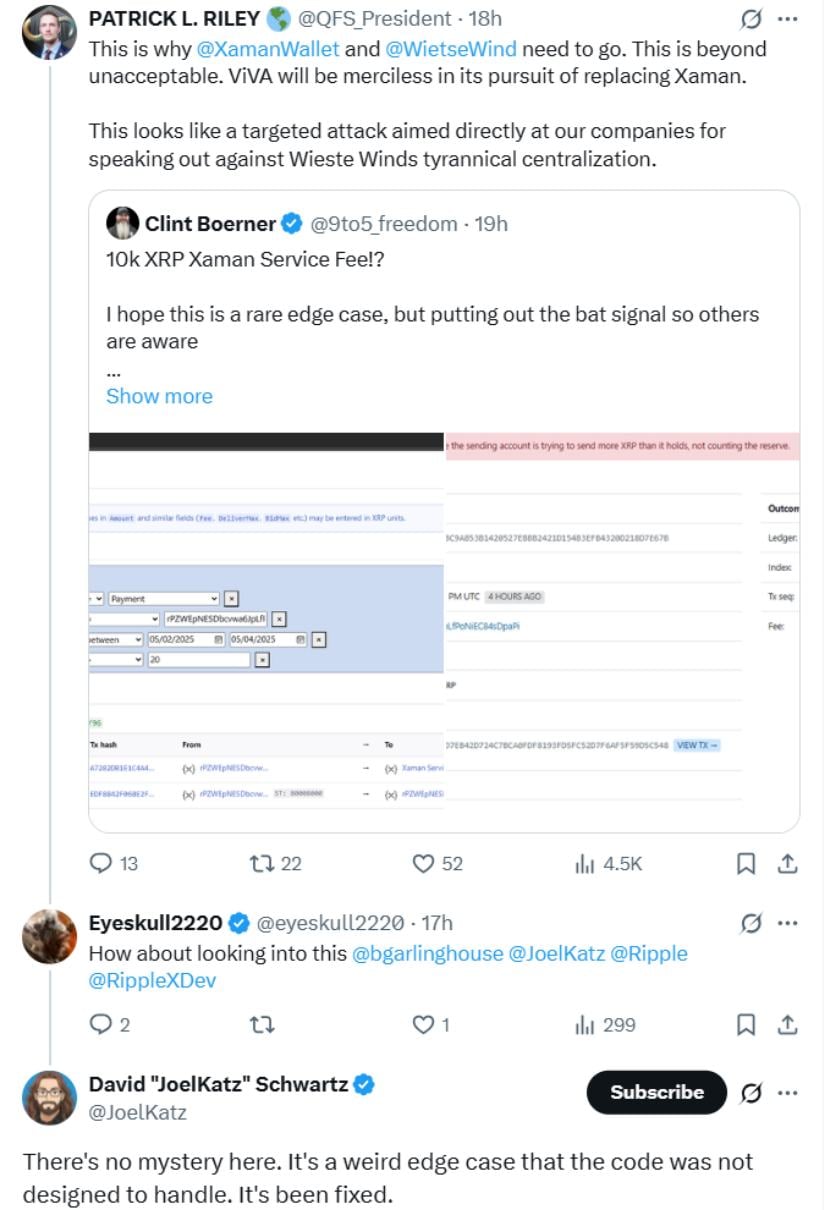

Ripple CTO Quashes Speculation Over 10,000 XRP Glitch

Technical concerns also surfaced this week following a flagged wallet transaction involving a failed 10,000 XRP payment on the XRP Ledger. The transaction, tied to a service fee on the Xaman Wallet, was labeled “UNFUNDED_PAYMENT” due to insufficient funds, but the amount triggered speculation across the Ripple XRP community.

Ripple CTO David Schwartz clarified the 10,000 XRP glitch was a rare, non-malicious error that’s now fixed with no funds lost. Source: David “JoelKatz” Schwartz via X

Ripple CTO David Schwartz quickly addressed the concerns, explaining that the incident was a rare edge-case bug and not a security breach or coordinated attack. “The glitch has now been fixed,” Schwartz stated, “and no funds were lost, as the transaction was never completed.”

While the Ripple ledger remains a robust decentralized payment protocol, the incident sparked debate over wallet reliability and raised questions about third-party infrastructure within the Ripple ecosystem.

Analyst: XRP “Isn’t Dead, It’s Just Loading”

Long-time XRP observers argue that the asset is simply in a transitional phase. Influencer John Squire reminded followers that RippleNet is active in over 55 countries and has partnerships with major institutions like SBI, Tranglo, and Santander.

“XRP is the only top 10 coin to fight the U.S. government and survive,” he noted, referring to the extended Ripple lawsuit news cycle. This resilience, he argued, could set XRP apart in the next phase of crypto adoption.

The sentiment aligns with broader optimism among Ripple backers, who view XRP not as a speculative gamble but as a foundational piece of future financial infrastructure. According to Ripple currency price watchers, it’s not just about weathering the legal storms—it’s about building steadily for mainstream use.

XRP Price Sentiment Divided as Predictions Vary Widely

While some remain cautious due to the token’s prolonged consolidation and failure to break past its seven-year-old all-time high, others maintain a more bullish stance. Analyst Davinci Jeremie sees a potential 970% surge, targeting $24 by the end of 2025. More aggressive predictions, like that of Edoardo Farina, suggest a future XRP value as high as $10,000—though such claims remain highly speculative.

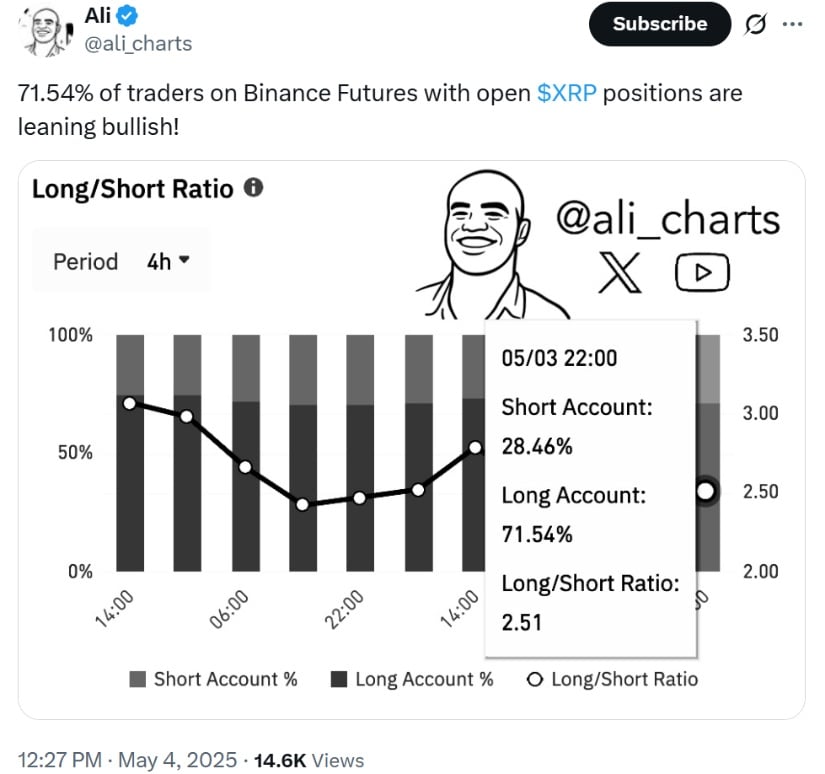

71.54% of Binance Futures traders with open XRP positions are betting on a bullish breakout. Source: Ali Martinez via X

“XRP isn’t risky. The biggest risk is having no $XRP,” Farina stated on X, urging investors to consider even modest positions. He cited XRP Rich List data showing that owning just 2,500 XRP places a holder within the top 10% globally.

Final Thoughts

As XRP navigates a pivotal moment shaped by legal uncertainty, technical clarification, and long-term faith in Ripple’s mission, the divide between skeptics and believers has rarely been sharper. The coming days, particularly the SEC’s May 8 meeting, may provide critical clarity that reshapes Ripple news and the broader XRP price trajectory.

With ETF prospects still on the table, renewed attention to the Ripple exchange ecosystem, and increasing institutional interest, XRP’s role in the evolving digital economy continues to deepen, despite temporary dips in price. Whether it’s a “trap for bears” or the quiet before a breakout, the Ripple crypto story is far from over.

Leave feedback about this