A crypto analyst says Bitcoin could reach $160,000 if bulls stay in control, the former CEO of Celsius receives a 12-year prison sentence, and other news.

by Editorial Staff 7 min May 10, 2025

Top Stories of The Week

Mashinsky’s 12-year sentence sets tone of enforcement in Trump era

The US federal court for the Southern District of New York has sentenced former Celsius CEO Alex Mashinsky to 12 years in prison for fraud.

Mashinsky’s legal team sought a light sentence. They highlighted his spotless record before the Celsius incident, along with his military service and willingness to plead guilty. But US prosecutors were less inclined to leniency, suggesting on April 28 that the judge deliver a 20-year sentence for his actions.

Betting markets predicted a light sentence ahead of the May 8 hearing. Polymarket showed only 11% odds for a 20-year sentence or higher.

US VP Vance to speak at Bitcoin conference amid Trump crypto controversies

US Vice President JD Vance will speak at the Bitcoin 2025 conference in Las Vegas, roughly a year after then-presidential candidate Donald Trump spoke at the same event.

According to a May 9 notice from the event’s organizers, Vance will address conference attendees in person on May 28, making him the first sitting US vice president to speak at a digital asset conference.

Trump provided a pre-recorded video of himself from the White House to the organizers of the Digital Asset Summit in March — his first appearance at a crypto event since taking office in January — and spoke in person at the Bitcoin 2024 conference in Nashville while campaigning.

Former FTX exec’s wife says gov’t ‘induced a guilty plea’

Michelle Bond, the wife of former FTX Digital Markets co-CEO Ryan Salame, who faces federal campaign finance charges, is pushing for dismissal on the grounds that US prosecutors deceived her husband in a plea deal.

In a May 7 filing in the US District Court for the Southern District of New York, Bond’s lawyers reiterated some of the claims Salame made in opposing his plea deal with the government, which ultimately still led to him serving time in prison. She claimed that prosecutors obtained a deal with Salame through “stealth and deception” by allegedly agreeing they would not file charges against Bond.

“Mr. Salame and Ms. Bond’s attorneys were advised that the agreement to cease investigating Ms. Bond could not be placed within the four corners of the Salame plea or other written agreement, but the government still offered it as an inducement to induce the plea,” said the filing.

Zerebro dev’s death in question as ‘proof’ surfaces on X

Members of the crypto community are circulating apparent “proof” that Zerebro developer Jeffy Yu faked his suicide as he promoted his new memecoin during a Pump.fun livestream on May 4.

The belief appears to come from an unverified private letter supposedly sent by Yu to a Zerebro investor, trading activity linked to crypto wallets owned by Yu, and the removal of his obituary from Legacy.com.

Others speculate that Yu used a tool to pass off a pre-edited video as if it were filmed in real-time during the Pump.fun live stream.

The unverified letter from Yu to an early investor states that he deliberately created a livestream pretending to shoot himself as it was the only “viable exit” from persistent harassment, blackmail, threats and hate crimes.

North Korean spy slips up, reveals ties in fake job interview

For months, Cointelegraph took part in an investigation centered around a suspected North Korean operative that uncovered a cluster of threat actors attempting to score freelancing gigs in the cryptocurrency industry.

The investigation was led by Heiner Garcia, a cyber threat intelligence expert at Telefónica and a blockchain security researcher. Garcia uncovered how North Korean operatives secured freelance work online even without using a VPN.

Garcia’s analysis linked the applicant to a network of GitHub accounts and fake Japanese identities believed to be associated with North Korean operations. In February, Garcia invited Cointelegraph to take part in a dummy job interview he had set up with a suspected Democratic People’s Republic of Korea operative who called himself “Motoki.”

Winners and Losers

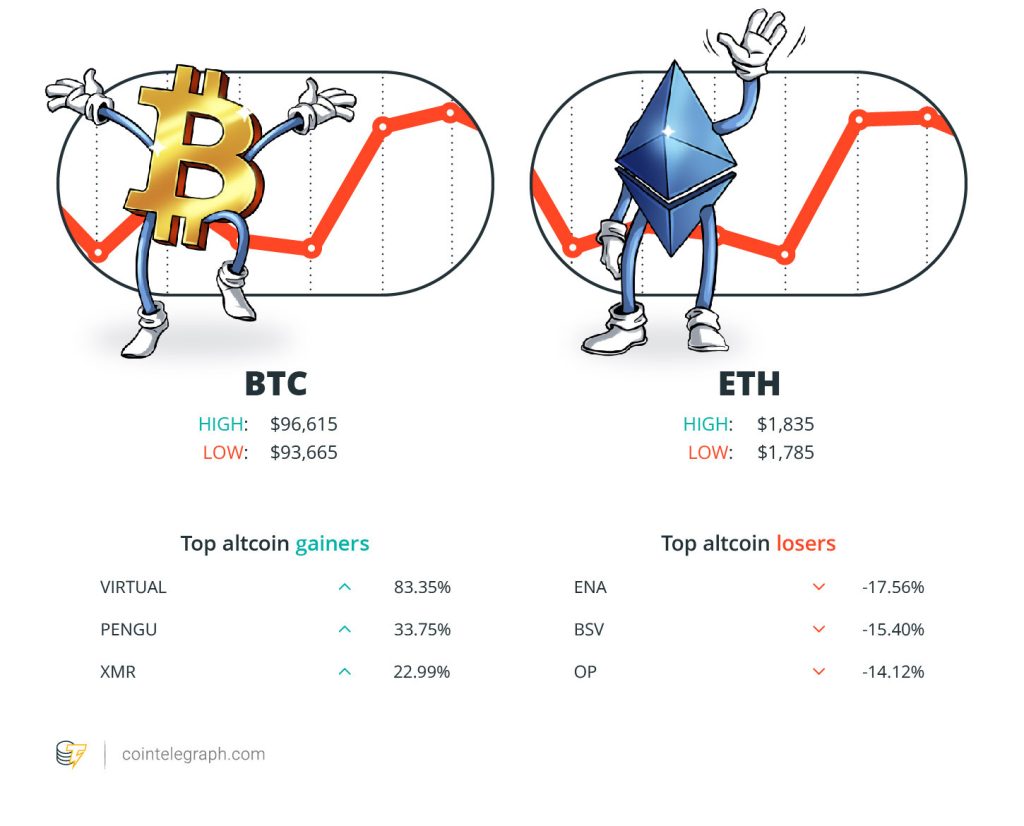

At the end of the week, Bitcoin (BTC) is at $103,024, Ether (ETH) at $2,338 and XRP at $2.35. The total market cap is at $3.26 trillion, according to CoinMarketCap.

Among the biggest 100 cryptocurrencies, the top three altcoin gainers of the week are Pepe (PEPE) at 46.63%, dogwifhat (WIF) at 27.96% and Ether (ETH) at 27.723%.

The top three altcoin losers of the week are Kaia (KAIA) at 2.26%, UNUS SED LEO (LEO) at 1.63% and XDC Network (XDC) at +0.41%. For more info on crypto prices, make sure to read Cointelegraph’s market analysis.

Most Memorable Quotations

“But today, people are more comfortable to borrow against Bitcoin because we’re nowhere near the levels that would trigger liquidation.”

Seamus Rocca, CEO of Xapo Bank

“I feel the team is doing well and doesn’t need me back.”

Changpeng “CZ” Zhao, former CEO of Binance

“We see potential for BNB to serve as a form of benchmark, or average, for digital asset prices more broadly.”

Geoff Kendrick, analyst at Standard Chartered

“AI could soon challenge the traditional dominance of DeFi and Gaming, signaling a new era in the DApp landscape.”

Sara Gherghelas, blockchain analyst at DappRadar

“We do not yet see convincing signs that Solana would be the preferred choice as Ethereum’s security, stability and longevity are highly prized.”

“It kind of feels weird. […] Normally in the press, Bitcoin mining is destroying the environment. It’s being used by money launderers. […] And instead, you’ve got the president encouraging Bitcoin.”

Dan Held, Bitcoin OG and entrepreneur

Prediction of The Week

Is Bitcoin about to go parabolic? BTC price targets include $160K next

Bitcoin is attracting “parabolic” price targets as bulls continue to hold six figures on May 9. Data from Cointelegraph Markets Pro and TradingView shows barely any consolidation taking place on BTC/USD over the past 24 hours.

Reacting, market participants have begun to restore their faith in the broader Bitcoin bull market.

“November 2024 monthly candle was the breakout signal on long-term charts,” popular economist Aksel Kibar told X followers in his latest post.

An accompanying chart compares November 2024 to similar “breakout” events in the past, with Kibar reiterating his existing $137,000 target.

Trader and analyst Matthew Hyland joined those forecasting new all-time highs in Q2 in his latest video update.

$160,000 or other “crazy numbers,” he said, could come into play if bulls stay in control and a key leading indicator, the relative strength index, supports further upside.

FUD of The Week

60K Bitcoin addresses leaked as LockBit ransomware gang gets hacked

Almost 60,000 Bitcoin addresses tied to LockBit’s ransomware infrastructure were leaked after hackers breached the group’s dark web affiliate panel.

The leak included a MySQL database dump shared publicly online. It contained crypto-related information that could help blockchain analysts trace the group’s illicit financial flows.

Ransomware is a type of malware used by malicious actors. It locks its target’s files or computer systems, making them inaccessible. The attackers typically demand a ransom payment, often in digital assets like Bitcoin, in exchange for a decryption key to unlock the files.

$45 million stolen from Coinbase users in the last week — ZachXBT

Pseudonymous onchain sleuth and security analyst ZachXBT claims to have identified an additional $45 million in funds stolen from Coinbase users through social engineering scams in the past seven days alone.

According to the onchain detective, the $45 million figure represents the latest financial losses in a string of social engineering scams targeting Coinbase users, which ZachXBT said is a problem unique among crypto exchanges:

“Over the past few months, I have reported on nine figures stolen from Coinbase users via similar social engineering scams. Interestingly, no other major exchange has the same problem.”

Voltage Finance exploiter moves $182K in ETH to Tornado Cash

A hacker involved in the $4.67 million exploit of the decentralized finance lending protocol Voltage Finance in 2022 has moved some of the stolen Ether to Tornado Cash after a short hibernation.

Blockchain security firm CertiK said in a May 6 post to X that the 100 Ether, worth $182,783 at current prices, was moved from a different address initially used in the exploit but can be traced back to the hacker.

In March 2022, the exploiter took advantage of a “built-in callback function” in the ERC677 token standard and allowed them to drain the platform’s lending pool through a reentrancy attack, according to CertiK.

Top Magazine Stories of The Week

Adam Back says Bitcoin price cycle ’10x bigger’ but will still decisively break above $100K

Adam Back says asking him if he’s Satoshi isn’t “crazy speculation,” and that he has “empathy” for those who buy Bitcoin via the ETFs.

Finally blast into space with Justin Sun, Vietnam’s new national blockchain: Asia Express

Justin Sun the astronaut, Vietnamese TradiFi firms launch national blockchain, Korean crypto exchanges delay withdrawals due to scammers and more.

ChatGPT a ‘schizophrenia-seeking missile,’ AI scientists prep for 50% deaths: AI Eye

Mentally ill users might be accidentally jailbreaking ChatGPT into reinforcing their delusions. Enkrypt uncovers new LLM exploit embedded into images.

Subscribe

The most engaging reads in blockchain. Delivered once a week.

![]()

Editorial Staff

Cointelegraph Magazine writers and reporters contributed to this article.

Leave feedback about this