In recent developments, XRP, the cryptocurrency associated with Ripple, has seen several pivotal events unfold, including the launch of the first-ever XRP ETF in the United States. This marks a significant milestone for the cryptocurrency, offering a new way for investors to gain exposure to XRP.

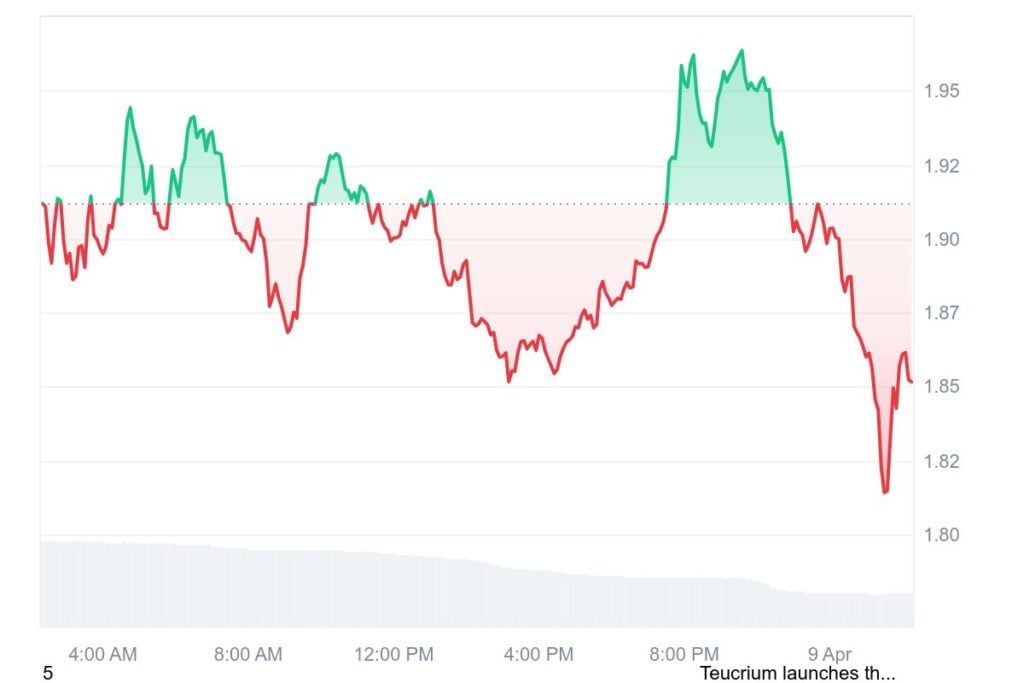

Despite the excitement surrounding the ETF launch, the market reaction has been more subdued than expected, with $XRP showing some volatility. After hitting a high of $1.97, it pulled back to around $1.85, highlighting the ongoing challenges in the market.

While the price fluctuation may seem concerning to some, it is largely viewed as a temporary reaction, likely influenced by profit-taking and market manipulation rather than any fundamental weaknesses in XRP itself.

Hidden Road Acquisition Could Be a Bullish Catalyst for XRP, Despite Current Price Action

Another major announcement is Ripple’s recent acquisition of Hidden Road for $1.25 billion, a move that has flown under the radar but could be much more bullish for XRP than current price action suggests.

Hidden Road, a prime broker, provides institutional services to top financial institutions, and part of its capital and activity will now tap into the XRP ledger.

Source – Austin Hilton on YouTube

This could have significant implications for XRP’s growth, as it may attract more liquidity, decentralized applications, and developers to the network. The acquisition is structured as a mix of cash, XRP, and stock, showing Ripple’s commitment to expanding its operations.

Additionally, the use of ROUSD as collateral in the prime brokerage services could elevate XRP’s role in the growing stablecoin narrative However, it remains to be seen how much of this capital and activity will directly impact XRP’s ledger.

XRP Price Prediction

In the short term, $XRP’s price is still largely influenced by Bitcoin’s performance, and its correlation to Bitcoin remains high. If Bitcoin sees a recovery, XRP may reclaim $2 and move back into its established range. However, if Bitcoin experiences a pullback, $XRP is likely to follow.

Despite this, the acquisition signals long-term growth potential for XRP, and it could make the token more attractive to investors, especially at price bottoms. This news highlights the ongoing developments at Ripple, and the future for XRP could be much more promising than it initially appeared.

XRP’s Resilience Amid Economic Uncertainty: Ripple’s Post-SEC Strategy Is Paying Off

Despite these positive developments, the broader financial market is facing turbulence, with geopolitical tensions and economic uncertainty contributing to market fluctuations.

These macroeconomic factors, particularly the ongoing tariff issues between the United States and China, have created a volatile environment for all assets, including cryptocurrencies.

While XRP’s price may not have surged in response to these recent events, the long-term implications of Ripple’s strategic moves are seen as highly positive, with many anticipating that the company’s expanding influence and partnerships will pay off in the future.

Ripple’s approach to navigating the post-SEC era has also been noteworthy. With the SEC lawsuit out of the picture, the company is moving forward with more confidence, forging significant deals and partnerships that position XRP for future growth.

This reflects Ripple’s ongoing efforts to integrate XRP into various sectors, including international money transfers, clearing services, and financial transactions between organizations, governments, and businesses.

These strategic moves are setting the stage for the future of Ripple and XRP in the global financial landscape, though the immediate market reaction may not fully reflect the potential long-term benefits.

In conclusion, while the market for XRP may be facing short-term volatility, the underlying developments point to a promising future for the crypto. Ripple’s acquisition of Hidden Road and the launch of the XRP ETF signal the company’s continued expansion and its ability to tap into major financial markets.

As the broader economic situation evolves, XRP’s strategic positioning could lead to significant growth, making it an asset to watch closely in the coming months.

Leave feedback about this