XRP price momentum has hit a wall this week, with the digital asset slipping below key technical levels amid growing macroeconomic pressures and shifting sentiment.

On May 7, 2025, the XRP price tested a two-week low of $2.08—its fifth straight session in the red. While the recent drop raises short-term concerns, Ripple’s latest market report reveals emerging institutional interest that could play a critical role in shaping the cryptocurrency’s long-term trajectory.

XRP Price Slips to $2.10 as Selling Pressure Intensifies

The XRP value dropped over 7% in the last five days, closing in on key support between $1.77 and $1.90. TradingView data shows a descending triangle pattern forming on the daily chart—a bearish signal that may indicate a further drop toward $1.20 if current support levels fail.

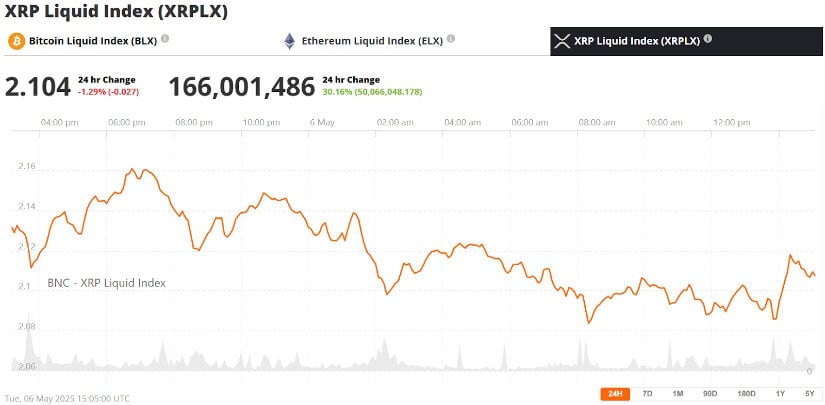

XRP was trading at around $2.10, down 1.29% in the last 24 hours at press time. Bitcoin Liquid Index (BLX) via Brave New Coin

“This is not just market-wide fatigue,” said Paul Howard, Director at Wincent. “XRP has increasingly decoupled from Bitcoin’s price action and now responds more to ecosystem-specific developments.”

Contributing to the price weakness is a noticeable decrease in Ripple ledger activity. Daily active addresses on the XRPL have shrunk to around 30,000, according to Santiment, with whale addresses showing distribution behavior—a sign that large holders are cashing out amid volatility.

Broader Market Jitters and Regulatory Uncertainty Fuel Caution

The XRP downturn doesn’t exist in a vacuum. The broader crypto market is wobbling ahead of the May 7 FOMC meeting and March PCE inflation data, both of which could sway monetary policy. Additionally, newly enacted trade tariffs under President Trump’s administration and retaliatory measures from China have injected further economic tension.

“Volatility is creeping back, and uncertainty around tariffs looms,” noted Markus Thielen, CEO of 10x Research. “This is not a time for blind risk-taking.”

These macroeconomic risks have already triggered a significant correction in digital assets, with Ripple XRP news reflecting a nearly 45% drop from April highs of $3.20.

Profit-Taking Emerges After a Massive Rally

After soaring 600% in late 2024—from $0.50 to over $3.00—XRP became ripe for profit-taking. In early April alone, more than $1 billion worth of XRP positions were liquidated at an average price of $2.10, according to CoinGlass. This aggressive repositioning by short-term traders has added downward pressure, amplifying losses even in the face of positive Ripple news.

XRP’s sideways price action signals controlled institutional accumulation via TWAP/VWAP, likely in preparation for a spot ETF approval. Source: Max Avery via X

Despite the recent price turbulence, some investors remain optimistic that the latest developments in the XRP lawsuit and ecosystem upgrades could eventually support a recovery.

Ripple Ends Market Report Format Amid Institutional Surge

Ripple’s Q1 2025 XRP Markets Report, released May 6, has stirred interest in the project’s evolving strategy. The company announced it will sunset its existing quarterly format after Q2, citing the need to offer deeper institutional insights. The report noted that transparency, originally a strength, had at times been used against Ripple, especially during confrontations with former SEC Ripple leadership.

“In many instances, Ripple’s transparency has been used against the company,” the report stated. “As more institutions engage with XRP, additional perspectives and insights are expected to follow.”

The timing of the move aligns with surging institutional appetite for Ripple crypto products. XRP-based investment vehicles saw $37.7 million in net inflows during Q1—nearing the $214 million year-to-date total for Ethereum products. A leveraged XRP ETF also launched in April, while multiple spot ETF filings await XRP SEC approval.

RLUSD Stablecoin Shift Sparks Speculative Uncertainty

Another factor weighing on investor confidence is Ripple’s strategic focus on RLUSD, its new Ripple currency price stablecoin. While RLUSD plays a crucial role in cross-border transactions and has already reached a $90 million market cap, its rise has sparked concerns that XRP could lose its central role in Ripple’s long-term vision.

Ripple’s $25M pledge gives RLUSD a major credibility boost, spotlighting its real-world utility despite skepticism over its small market cap. Source: Alva via X

Posts circulating on X have questioned whether XRP will remain the primary utility token in the ecosystem. Though RLUSD may enhance XRPL’s overall utility, it also muddies the waters for speculative interest in XRP.

XRP Lawsuit Update: Resolution Comes, but ETF Delays Persist

Ripple’s legal battle with the SEC reached a milestone recently, with a $50 million settlement bringing an end to a four-year-long regulatory clash. While the XRP lawsuit news was expected to trigger bullish momentum, the market reaction has been muted.

Analysts suggest the outcome was already priced in, while delays in XRP ETF approvals continue to frustrate investors. The SEC has postponed decisions on several key filings—including those from Franklin Templeton and Bitwise, pushing potential approval timelines into late Q2 and Q3.

XRP Price Prediction: Recovery Hinges on Resistance Break

Despite recent weakness, analysts believe XRP could stage a comeback if certain conditions are met. A decisive break above the $2.26 resistance level would signal a bullish reversal. In parallel, long-term catalysts such as spot ETF approvals, increased XRPL fee burns, and supportive regulatory leadership could reignite institutional demand.

Following a massive 600% rally, XRP’s recent downturn stems from investors locking in gains, with over $1B offloaded in early April around $2.10. Abc_trades on TradingView

Current data shows XRPL fees have risen by 38% week-over-week, reducing the token’s circulating supply. Additionally, pro-crypto SEC Chairman Paul Atkins may pave the way for a more favorable regulatory climate, critical for XRP’s next chapter.

Looking Ahead: A Market in Flux

XRP is under pressure, with its price dropping to $2.08 as of May 6, 2025. This decline is driven by a complex mix of technical breakdowns, macroeconomic uncertainty, profit-taking, and shifting priorities within Ripple’s ecosystem. However, the company’s move to overhaul its reporting strategy and rising institutional demand may offer a silver lining.

As traders continue to watch for developments in the Ripple lawsuit and ETF space, the road ahead remains uncertain, but not without potential. The coming weeks will likely test the resilience of XRP investors and the adaptability of Ripple’s broader strategy.

Leave feedback about this