Ripple’s native token, XRP, is once again in the spotlight after a massive on-chain transaction triggered fresh speculation about a bullish breakout.

A large-scale Ripple whale transferred 29.5 million XRP, valued at over $64 million, to Coinbase. This notable movement has been interpreted by many analysts as a signal of potential institutional activity, possibly laying the groundwork for a significant XRP price surge.

Whale Movement Sparks Market Speculation

The $64 million whale transfer follows a broader trend: wallets holding between 10 million and 100 million XRP have accumulated more than 200 million tokens in the past week, according to Santiment. This surge in whale activity has coincided with renewed optimism in the market, especially as Ripple’s legal outlook improves and XRP ETF chatter gains momentum.

A total of 29,532,534 XRP, valued at approximately $64.4 million, was transferred from an unknown wallet to Coinbase. Source: Whale Alert via X

“The whales are positioning themselves ahead of what could be a sharp move,” noted one market observer. The transfer to Coinbase, a major Ripple exchange partner, is being seen as a possible precursor to a liquidity event or market entry by deep-pocketed investors.

XRP Price Outlook Remains Bullish

XRP is currently trading around $2.20, showing resilience after a brief dip to $2.15. The pullback on April 30 led to over $13 million in long position liquidations. Despite the shakeout, XRP continues to hold above its 20-day simple moving average (SMA) of $2.1677, a level viewed as a key support zone.

XRP is nearing a potential 30% breakout against Bitcoin as narrowing Bollinger Bands signal an imminent price move. Source: Brett via X

Technical indicators point toward a consolidation phase with bullish undertones. The Bollinger Bands have narrowed—a pattern that often precedes explosive price movements. The upper band, currently at $2.3082, marks the immediate resistance. A decisive close above this level could open the doors for XRP to test higher targets near $2.50 and $2.80.

Crypto analyst Javon Marks shared a cautiously optimistic view, stating, “Lower timeframes are flashing bullish signs, and the current setup hints at another upward move for XRP.”

Mixed Signals from Momentum Indicators

While the fundamentals and whale behavior suggest a bullish narrative, momentum indicators present a more nuanced picture. The Relative Strength Index (RSI) stands at 52.44, hovering just above the neutral zone. This modest uptick indicates growing buying interest but not yet a full-blown rally.

Meanwhile, the Chaikin Money Flow (CMF) sits at -0.13, pointing to minor capital outflows. However, this level is still close to the neutral line, suggesting that bearish pressure remains limited.

Analysts are closely watching for a breakout above the $2.31 mark with increasing volume. Such a move would confirm bullish strength and potentially ignite a rally into price discovery territory—a zone XRP hasn’t visited in years.

Long-Term Potential: $10, $20, or Even $50?

XRP’s current trajectory is being compared to its historical rallies. In the 2017 bull run, XRP skyrocketed from $0.006 to nearly $4. Many believe a similar parabolic move could occur again, particularly if broader crypto market conditions align.

A recent report from TronWeekly highlighted XRP’s sideways movement between $1.50 and $2.50. Though momentum has been lacking in recent weeks, the token continues to test multi-year resistance levels. A breakout here could be the beginning of a massive price discovery phase.

Analysts highlight XRP’s long-term potential, projecting possible price targets of $10, $20, or even $50. Source: Crypto_Curry on TradingView

More aggressive predictions have since been made following Ark Invest’s bullish Bitcoin prediction. The company believes that in its most favorable case, BTC could hit $2.4 million by the year 2030. In light of XRP’s history of price movement correlation with Bitcoin, such a development would take XRP price to $50 or more.

If XRP tracks Bitcoin’s projected 2,400% growth,” The Crypto Basic reported, “it could increase from $2.27 to as high as $56.75.” While this projection is speculative, it reflects the high expectations among the XRP community.

Ripple Lawsuit and Regulatory Clarity Remain Key Catalysts

Regulatory developments continue to play a critical role in shaping XRP’s price outlook. The XRP SEC lawsuits, which have been unfolding for over three years, remain a major overhang. However, recent updates in the Ripple lawsuit have tilted sentiment in Ripple’s favor.

Ripple CEO Brad Garlinghouse has been hopeful that the firm will eventually prevail in its court battle with the U.S. Securities and Exchange Commission (SEC). A favorable decision for Ripple would provide much-needed clarity not just for XRP but for the entire crypto industry as well.

In addition, speculation on Ripple’s deepening connection with established financial players like Bank of America and a potential Ripple ETF is fueling the bull case. As regulatory uncertainty is assuaged, Ripple XRP news will be more and more prone to define headlines, especially if new applications and partnerships become a reality.

Final Thoughts: XRP at a Crossroads

XRP stands at a critical juncture. Whale activity, positive technical formations, and optimistic long-term forecasts all point to significant upside potential. However, short-term caution remains warranted due to mixed momentum signals and ongoing regulatory headwinds.

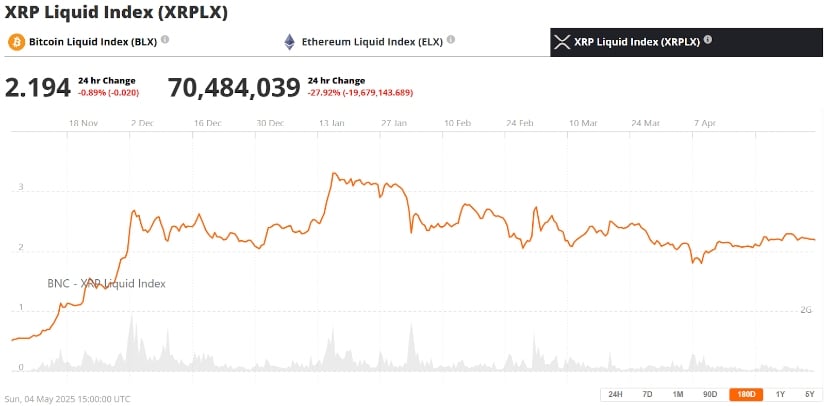

XRP was trading at around $2.19 at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

Still, the broader Ripple market narrative is becoming increasingly compelling. As altcoin season progresses and Bitcoin continues to surge, XRP appears well-positioned to ride the wave, possibly toward new all-time highs.

For now, investors are closely monitoring the $2.31 resistance level. A successful breakout could mark the beginning of a new bullish chapter in XRP’s story.

Leave feedback about this