XRP continues to show resilience in the face of market uncertainty, holding firm above the pivotal $2.20 support level and eyeing further gains.

Now trading near $2.28 after rebounding from a monthly low of $1.61, the token is attracting fresh bullish attention. A breakout above $2.40 could set the stage for a push toward the $3.00 mark, as technical indicators point to a potential trend reversal within the current descending channel.

Technical Indicators Show Mixed Signals

Technical indicators present a blend of optimism and caution. The 50-day and 100-day Exponential Moving Averages (EMAs), positioned at $2.20 and $2.22, respectively, have acted as solid support zones. XRP also remains above its 200-day EMA at $1.98—often a long-term bullish signal.

XRP’s chart is messy, possibly finishing Wave C, but holding the 1.62 Fib level is key. Source: Tahoe Billy via X

Meanwhile, the Relative Strength Index (RSI) is currently neutral at 58.11, suggesting room for movement in either direction. The MACD (Moving Average Convergence Divergence), a popular momentum indicator, shows its blue line still above the signal line, typically a bullish signal. However, the shrinking MACD histogram hints that upward momentum may be waning.

Bollinger Bands analysis adds further complexity. XRP is trading near the upper band, which often suggests overbought conditions. Tightening bands may indicate an imminent period of volatility, possibly leading to a significant move up or down.

XRP Lawsuit Update and ETF Buzz Add Fuel

Most investors’ optimism for XRP comes from more general news in the Ripple ecosystem. The ages-old Ripple lawsuit against the United States Securities and Exchange Commission (SEC) also appears to be nearing its conclusion. Early in the month, a temporary stay was granted for the appeals to make room for settlement talks between Ripple and the SEC.

The SEC has postponed its decision on Franklin Templeton’s proposed XRP spot ETF to June 17. Source: Eleanor Terrett via X

A potential settlement could pave the way for Ripple XRP news and open the door for further institutional interest. Ripple CEO Brad Garlinghouse has already hinted at the firm’s post-lawsuit plans for expansion, fueling market speculation.

Adding to the bullish case is the announcement of upcoming XRP futures ETFs. Although initial reports incorrectly suggested that a spot XRP ETF would launch on April 30, ProShares and Bloomberg ETF analyst James Seyffart confirmed that no such listing is currently scheduled.

Nonetheless, the availability of XRP futures ETFs—especially leveraged and inverse products—represents a meaningful step toward broader financial adoption. “The ETF launch is still expected in the short to medium term,” Seyffart clarified.

Market Sentiment and Derivatives Data

The broader crypto space is also helping to underpin the price of XRP. Bitcoin remains strong above $94,000, and some of the best-performing altcoins like Floki and Hyperliquid (HYPE) have produced significant gains, suggesting increased investor appetite for risk assets.

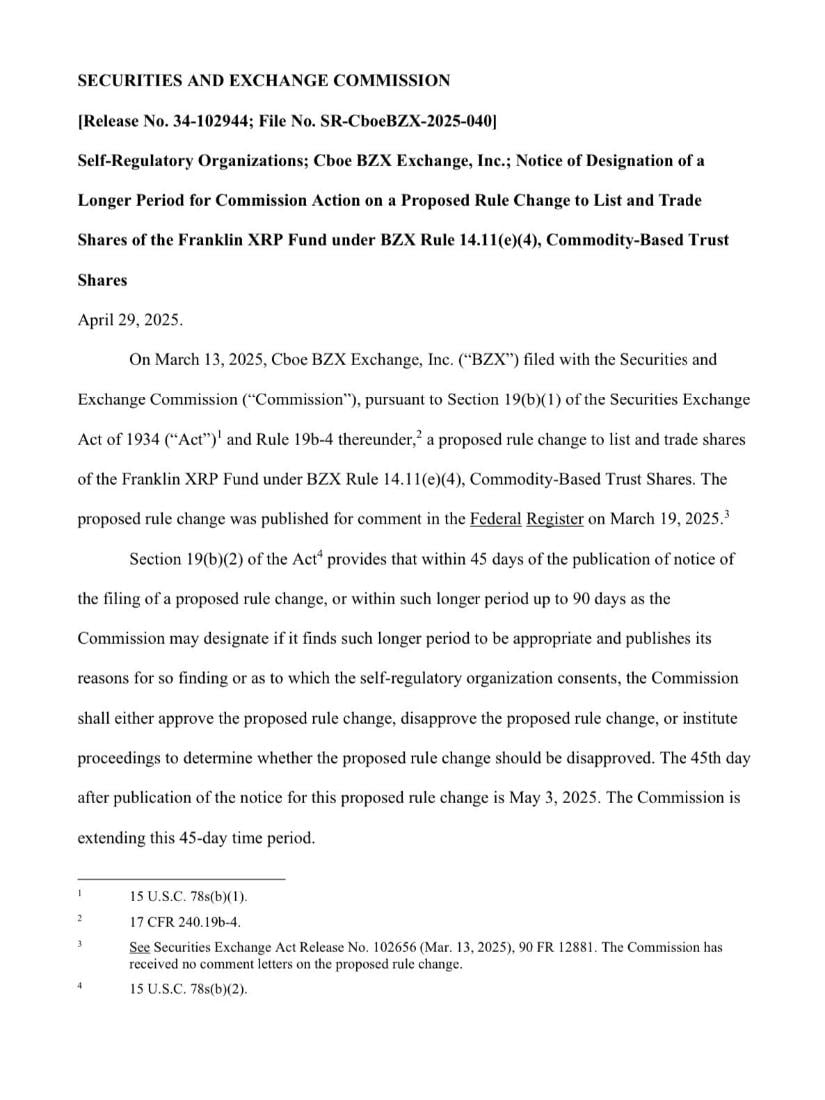

XRP was trading at around $2.29, up 1.06% in the last 24 hours at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

CoinGlass derivatives data reflect a modest increase in XRP Open Interest to $4 billion, which would indicate new positions being established. However, the long/short ratio of 0.9559 indicates there are more sellers shorting XRP than there are buyers, a potential reflection of market trepidation.

Over the past four hours, around $350,000 of long positions were closed out compared to $59,000 worth of shorts. The difference reflects weakening bullish conviction on the part of leveraged traders.

What Needs to Happen for XRP to Hit $3?

For XRP to fulfill its breakout potential, it must first decisively clear resistance at $2.40. Beyond that, supply zones at $2.80 and $3.00 could pose additional hurdles. Analysts agree that volume will be key—higher buying volume on upward moves will be necessary to propel the Ripple currency price beyond these psychological barriers.

XRP appears to be breaking out of an inverse head and shoulders pattern, aiming for a potential upside between $2.70 and $2.90. Source: Ali Martinez via X

If XRP fails to hold its current support levels, a retest of the 200-day EMA at $1.98 is possible. In a more bearish scenario, the price could slide further to $1.80.

Chart analyst “Charting Guy” recently shared his XRP forecast, predicting a gradual rally toward $8 over time, but cautioned against irrational expectations. “From $0.28 to $8 is a 2,750% move. Take profits along the way,” he advised.

Looking Forward: Key Levels and What to Watch

XRP’s price remains at a critical juncture. The $2.20–$2.22 range is acting as a major support zone, while resistance at $2.40 continues to cap the upside. With the XRP lawsuit potentially nearing a conclusion and futures ETFs adding legitimacy, traders are eyeing a breakout toward $3.

However, technical indicators suggest that the token is entering a consolidation phase. Whether this leads to a breakout or breakdown will largely depend on broader market conditions, upcoming Ripple news, and the outcome of Ripple’s legal negotiations with the SEC.

As the end of April approaches, all eyes remain on XRP—and whether the Ripple crypto can turn ETF excitement and lawsuit resolution into a catalyst for the next major rally.

Leave feedback about this